Why the silence?

(by peter)

Was it slippery self-protection, sullenness or maybe inside knowledge that there’s a genuine chance of policy change on alcohol taxation?

Was it slippery self-protection, sullenness or maybe inside knowledge that there’s a genuine chance of policy change on alcohol taxation?

I’ve got a view on the latter (see penultimate paragraph below) but either way, Secretary of State for Communities and Local Government Eric Pickles’ refusal to engage in any sort of meaningful debate when I went on BBC2’s Daily Politics to call for an end to the super tax known as the alcohol duty escalator (ADE) was both baffling and, I thought, shameful.

It warrants a statement of clarification from the government at the very least. Peoples’ livelihoods are at stake here.

I was on the programme to discuss the ADE and why it should be discontinued. I filmed a piece in Hambledon vineyard outlining the case and then went into studio for what I thought would be a constructive discussion with show hosts Jo Coburn and Andrew Neil plus Pickles and Labour MP Gareth Thomas. In the end, it largely turned into a conversation between Coburn and me.

Below is the clip from the programme. You can find the full programme on iplayer (relevant piece is at 1:16:35) and a brief piece on BBC news with the VT.

A couple of points to make:

- The ADE is a revenue-raising mechanism put in place in 2008 by Alistair Darling via which alcohol excise duty is raised at 2% above inflation automatically every year. George Osborne has continued this (when he says ‘no change’ in his budgets he means no change to the automatic raise).

- The ADE is counter-productive. Independent research by Ernst and Young indicates that scrapping the ADE this budget would boost public finances by £230 million, add £1 billion to the economy and create 6,000 new jobs. By contrast, keeping the ADE for just one more year would lead to 2% fewer jobs in the sector, some £469 billion less for GDP and £250 million less for government coffers. The logic doesn’t add up.

- This seeming paradox is partly because raising prices depresses sales – but also because tax contributions aren’t just from booze sales but also corporation tax, income tax and the benefit to the wider economy by workers in the sector.

- The ADE for beer was scrapped in 2013, touted as a measure to support pubs, yet 42% of on-trade sales are wines and spirits and keeping the ADE last year cost these venues £34 million extra. I spoke to one pub chain buyer who said pubs are desperate to sell more wine and spirits – it’s less labour intensive, good with food and attracts a diverse clientele. (He even added: ‘bring back beer ADE if it means we can scrap it on wine!’)

- There are 213 distilleries and nearly 450 commercial vineyards in the UK. These industries need nurturing to remain world class (in the case of spirits like scotch, vodka and gin) or fulfill their full potential (home-grown wine, especially fizz). This in addition to a multi-billion pound business including distributors, bars, restaurants, producers, logistics, importers and others. The booze trade supports a million jobs in the wider community and pays £17 billion in tax every year.

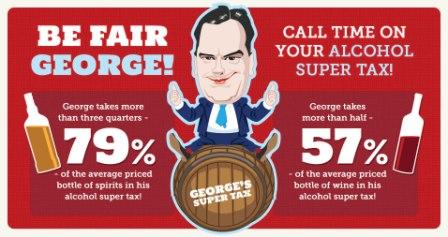

- But it’s not just about economics and business. Choice is being eroded for sensible drinkers as producers are forced out of the market by incessant cuts in margin and prices keep going up. Tax on wine has gone up 50% since 2008. In relation to average priced products, tax accounts for a whopping 57% of wine and 79% of spirits. Pay £5 for a bottle of wine and only about 50-80p actually goes on wine.

- Britian has the third highest tax on wine and fourth highest tax in spirits in the EU. Ernst & Young’s report does not include lost revenue due to fraud or cross-border smuggling.

- Coburn challenged me as to whether alcohol was still actually cheap despite the ADE. ONS figures indicate that booze has gone up roughly double the rate of inflation in recent years, whereas incomes have stayed flat, and has risen 24% over average retail prices in the last few decades.

- Overall alcohol consumption in the UK is in decline (down 14% since 2004) and so are incidences of binge drinking. No one would deny that alcohol can contribute to social and health problems but this needs a more joined-up policy than simply raising prices artificially and penalizing the responsible majority.

I challenge anyone who either works in the drinks trade, enjoys the odd tipple or wants to support our economy to sign up to the Call Time on Duty campaign calling for an end to ADE. It’s easy and quick to do – it just sends an automatic letter to your MP, and the campaign needs numbers to influence Mr Osborne.

I also have a suspicion that Westminster will be keen, given its recent strategy regarding Scottish independence, to give Scotch (and thus presumably by default all spirits) something to cheer on budget day. Might this risk leaving wine out in the (costly) cold? If ever there were a reason to make your voice heard, this is it.

This briefest of actions will support local business and help preserve choice, diversity and affordability on our shelves. Because the implications of not having our voices heard now are clear, and they are depressing.